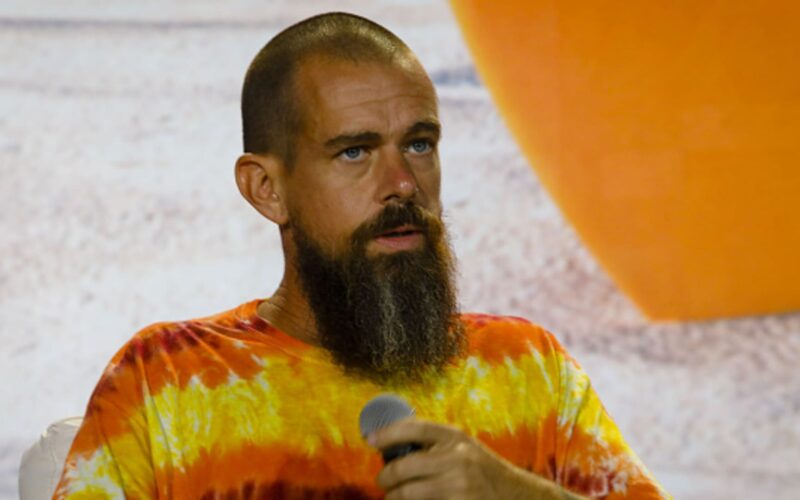

Shares of Jack Dorsey’s Block plunged 19% after quick seller Hindenburg studies introduced Thursday that the price organization become its latest short role, alleging that Block allowed criminal interest to operate with lax controls and “especially” inflates cash App’s transacting consumer base, a key metric of performance.

Hindenburg described Block’s internal systems as a “‘Wild West’ approach to compliance.”

“Our 2-yr research has concluded that Block has systematically taken benefit of the demographics it claims to be assisting,” Hindenburg stated in its record. The studies firm said Block’s coins App thrived on serving “unbanked” customers.

Read More: BlackRock denies document that it’s preparing a takeover bid for credit Suisse

The document alleges those unbanked customers had been concerned with criminal or illicit activity. Hindenburg additionally alleged that money App’s compliance applications were deficient.

As a part of its -year research, Hindenburg spoke with a couple of former personnel who described how inner concerns had been suppressed and personal concerns were neglected, whilst alleged “crook interest and fraud ran rampant on its platform.”

The firm’s considerable report includes screenshots of internal systems and worker messages. It additionally highlighted alleged monetary misreporting.

As much as 35% of the cash App’s revenue is derived from interchange fees, Hindenburg alleged. this is around $892 million in revenue that the short vendor stated ought to be capped with the aid of the law.

However, Block, previously called rectangular, avoids that regulatory cap imposed on massive monetary establishments by way of routing the sales through a small financial institution, Hindenburg alleged.

The small-bank routing method is one hired by means of Block rival PayPal, Hindenburg claimed, and which precipitated a Securities and alternate fee probe.

“A Freedom of Statistics Act (FOIA) request we filed with the SEC shows that Block can be part of a similar research,” Hindenburg wrote.

PayPal did not right away respond to a request for a remark.

Hindenburg took difficulty with coins App’s practices at some point during the Covid pandemic when the government issued stimulus assessments to certified American adults. The record alleges that the lockdowns “posed an existential danger” to the dam’s critical service provider offerings enterprise.

“CEO Jack Dorsey Tweeted that customers may want to get authorities payments through coins App ‘right away’ with ‘no financial institution account wished’ because of its frictionless generation,” the document said.

Only some weeks into cash App’s shipping of the primary round of presidency bills, states were apparently looking to claw back suspected fraudulent payments — “Washington nation desired extra than $200 million lower back from charge processors whilst Arizona sought to get better $500 million,” stated Hindenburg, bringing up multiple former personnel.

Bringing up interviews with former employees, Hindenburg alleged that “pressure from control has led to a sample of dismiss for Anti-money Laundering (AML) and recognize Your consumer (KYC) legal guidelines.”

The report notes that “this appeared to be an effort to grow coins App’s consumer base via strategically dismissing Anti-money Laundering (AML) guidelines.”

to check the theory, the short dealer opened money owed in the call of former President Donald Trump and Tesla CEO Elon Musk, after which acquired a cash App card, called the coins Card, below the “glaringly faux Donald Trump account,” the file said.

The card bearing Trump’s call arrived “promptly” inside the mail.

“Former employees predicted that 40%-seventy five% of bills they reviewed had been fake, worried in fraud, or have been extra debts tied to a single person,” the file stated.

Representatives for Block did not at once respond to a request for comment.

“In sum, we assume Block has misled buyers on key metrics, and embraced predatory offerings and compliance worst-practices in an effort to fuel increase and take advantage of facilitation of fraud against consumers and the government,” Hindenburg wrote.