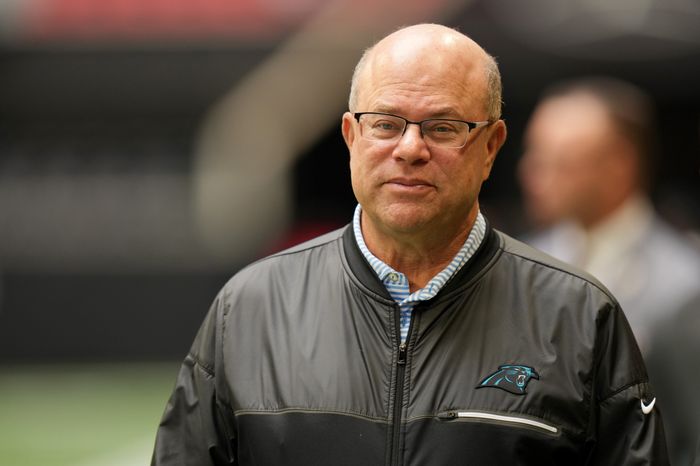

David Tepper shorting stocks as central banks raise rates, David Tepper, a veteran hedge fund manager, is betting against the stock market because he believes that central banks worldwide will continue to tighten monetary policy to curb inflation.

In an interview with CNBC’s Squawk Box on Thursday, the founder and president of the hedge fund Appaloosa Management said he is “leaning short on the equity markets” due to fears that rising interest rates will further batter stocks. Similarly, Tepper has stated that he is short on bonds.

According to Tepper, having so many central banks telling you what they’re going to do makes it hard to make sense of the upside/downside. Often, you have to take their word for it when they tell you what they plan to do.

Following Tepper’s remarks, major Wall Street averages continued their slide to session lows seen in Thursday’s pre-market trading. The Nasdaq dropped as much as 2.5%, and the S&P 500 dropped over 1.8% by late morning.

To paraphrase Tepper, owner of the NFL’s Carolina Panthers, “this is a tough year to talk about robust returns” for the S&P 500 because “you have the Feds – plural” in such a tightening mode.

The U.S. Federal Reserve raised interest rates by half a percentage point to a range of 4.25%-4.5% last week, the seventh increase this year, prompting the billionaire hedge fund manager’s comments. This year’s total interest rate increase of 4.25 percent was the highest since 1980.

Read more: The Mets swoop in to sign Carlos Correa to a 12-year 315 million contract.

Following the Federal Reserve’s lead, the European Central Bank, the Bank of England, and other central banks worldwide tightened policy to quell rising prices.

Last week, Fed Chair Jerome Powell indicated that more rate hikes would be on the horizon in the new year, reiterating that the Fed would continue to tighten financial conditions for as long as necessary to achieve its inflation target. Christine Lagarde, president of the European Central Bank, echoed Powell’s hawkishness the day after her bank raised interest rates by 0.50%.

Lagarde said at a press conference anyone who thinks the European Central Bank has made a U-turn should think again. There will be a period where interest rates will rise by 50 basis points per increase.

Over 55% of global labor force participation and a lack of immigrant labor in the United States, according to Tepper, have kept labor markets tight and contributed to persistently high inflation. In addition, he stated that the “mismatch” would likely remain.

It’s classic “Econ 101” cost-push inflation, and, “I think other central banks around the world are worried about it,” Tepper said. “I believe they are concerned about the inflation rate expected to remain firm at 3.5 percent, 3.7 percent, or 4 percent.”